SARS eFiling is a convenient and secure platform designed for the submission of tax returns and declarations, as well as other related services. It facilitates a smoother interaction between you and the South African Revenue Service (SARS).

Origins and Purpose of SARS

SARS, or the South African Revenue Service, was established by legislation to collect revenue and ensure compliance with tax law. Its eFiling service was introduced to modernise the tax collection process, making it easier for taxpayers to interact with SARS efficiently and to fulfil their tax obligations.

- The eFiling system was implemented to provide taxpayers with an accessible means to handle their tax affairs.

- To streamline tax filing and payments, and to provide a hub for accessing personal tax information.

Benefits of Using eFiling

Utilising the eFiling platform offers several advantages for taxpayers:

- File returns and make payments from anywhere, at any time.

- Faster processing of submissions and quicker feedback.

- Your personal information is protected through state-of-the-art security measures.

- Easy access to historical tax documents and records.

- Helps you to remain up-to-date with your tax obligations, reducing the risk of penalties.

By using SARS eFiling, you can manage your tax affairs with greater control and peace of mind.

Registration Process

Before you begin the registration process for SARS eFiling, it’s essential that you’re aware of the requirements and the steps involved. Accurate completion of the registration process is critical to ensure your access to the SARS eFiling system.

Registration Requirements for New Users

To register on the SARS eFiling platform, you must have the following:

- Your personal details, including a valid South African ID or Passport number.

- Your tax number, if you are already registered as a taxpayer.

- Proof of address, such as a utility bill, not older than 3 months.

- An email address to which SARS will send important communication, including your eFiling login details.

For Tax Practitioners:

- Registration with a recognised control body is mandatory.

- Details of your practice number and the information of the firm you are associated with.

For Employers:

- Company’s registration number and official business details.

- Details regarding the PAYE (Pay-As-You-Earn) registered with SARS.

Step-by-Step Guide to Register

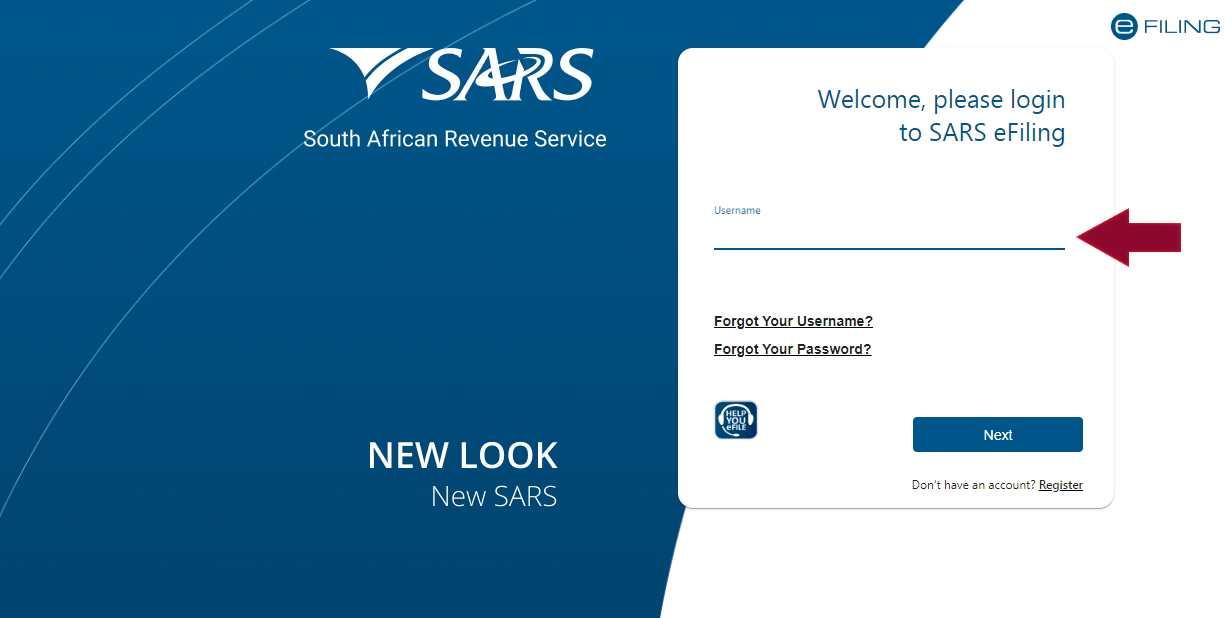

- Visit the SARS eFiling website and click on the ‘Register’ button.

- Choose the user type: individual taxpayer, tax practitioner, or employer.

- Fill in the online registration form with the requisite personal and/or business information.

- Submit your proof of address when prompted.

- Create a secure password and choose security questions for future verification purposes.

- Complete the verification process through a link sent to your provided email address.

- Log in to your account with the details received to begin utilising SARS eFiling services.

Remember to safeguard your login credentials and keep your personal information up to date to avoid any inconveniences.

Woolworths’ Digital Sustainability Initiatives Woolworths, like many modern businesses, is gravitating towards digital solutions to…

The UN’s Climate Change Conferences hold a pivotal role in shaping the global sustainability landscape.…

By delving into the intricacies of this process, we equip you with the knowledge and…

eFiling for Different Taxpayer Types

SARS eFiling offers comprehensive online services for different types of taxpayers, ensuring you can submit returns, declarations, and payments. Whether you are an individual, a business owner, or a tax practitioner, the system caters to your specific taxation needs with tailored sections.

Individual Income Tax Returns

As an individual taxpayer, you can file your income tax returns electronically using the SARS eFiling system. The process is designed to be user-friendly, ensuring that your tax affairs are in order.

- Registration: Ensure that you register for a personal eFiling account.

- Filing Returns: Access the “Returns Issued” section and then select the relevant income tax return form (ITR12).

- Submissions: You can submit the form directly after completion and ensure that all your personal details are up-to-date.

Businesses and Payroll Taxes

For businesses, including Small, Medium and Micro Enterprises (SMMEs), eFiling simplifies the management of corporate tax obligations.

- Pay As You Earn (PAYE): Employers can submit monthly declarations (EMP201) and reconcile bi-annual submissions (EMP501).

- Corporate Income Tax: Businesses must ensure that their company details are correct and file returns using the relevant forms (ITR14).

- VAT Submissions: Quarterly or monthly VAT201 returns can be submitted through your business eFiling profile.

Tax Practitioner Services

Tax practitioners have access to a suite of services on the eFiling platform, streamlining the process of managing clients’ tax submissions.

- Client Management: Maintain a list of clients and their respective tax portfolios.

- Bulk Actions: Perform bulk actions for a number of clients, like submissions and declarations, saving time and resources.

- Secure Correspondence: Communicate with SARS securely and receive timely notifications regarding client affairs.

Submitting Tax Returns

To successfully manage your tax affairs with SARS, understanding the process of submitting tax returns through the eFiling system is essential. This section leads you through the main steps from acknowledging the relevant deadlines to completing your tax return online and verifying its status once submitted.

Deadlines and Timelines

Your tax return is due every year, with deadlines set by the South African Revenue Service (SARS). The tax season typically begins in July, but specific deadlines for submission vary:

- Non-provisional taxpayers must usually submit their income tax returns by the end of October.

- Provisional taxpayers who file via eFiling have until the end of January of the following year.

Failure to adhere to these deadlines can result in penalties, thus it’s important to keep note of these dates and submit on time.

Completing a Tax Return Online

When filling in your income tax return through the SARS eFiling system, you’ll need to provide various details, such as:

- Personal Information: Verify that your personal details are up-to-date.

- Income Details: Include all sources of income, such as employment salary, business income, and any foreign income.

- Deductions: Claim any allowable deductions that apply to your situation.

To complete the return:

- Access the form by logging into your eFiling account.

- Navigate to the ‘Returns’ section, then select the current year’s income tax return form.

- Fill in the form with all the required information, making sure that all data entered is accurate to avoid any issues.

Verifying Submission Status

After submitting your tax return, confirmation of the submission is vital. You can check the status of your submission by:

- Logging back into your SARS eFiling account.

- Navigating to the ‘History’ tab where the status of all submissions can be reviewed.

Look for a status indicator such as ‘Filed’ or ‘Assessment in Progress’ to ensure that your tax return has been successfully received and is being processed by SARS. Should there be any issues with your submission, SARS will notify you, allowing for rectification within due time.

Support Services

When engaging with the SARS eFiling system, you have access to dedicated support services to assist with any queries or issues you may encounter. These include the SARS Contact Centre and the Online Query System, both designed to provide timely and effective assistance.

SARS Contact Centre Assistance

To receive direct support, you can contact the SARS Contact Centre. If you’re experiencing difficulties logging in or navigating the eFiling system, the Contact Centre’s trained representatives can guide you through the necessary steps. For your convenience, the contact numbers and operating hours are as follows:

- General Enquiries: 0800 00 7277 (0800 00 SARS)

- Operating Hours: Monday to Friday, 8:00 AM – 4:00 PM

Do have your tax reference number ready to hasten the service process.

Using the Online Query System

Alternatively, the SARS Online Query System provides an efficient channel for resolving your eFiling issues. To use this system:

- Log into your eFiling account.

- Navigate to the ‘Query’ section.

- Select the relevant query type and detail your issue.

Once submitted, you will receive a reference number for your query. This system allows you to track the status of your enquiry and receive updates directly through your eFiling account.

Payments and Refunds

Managing your tax obligations effectively involves understanding how to make payments to SARS and how the institution processes refunds. It’s essential for you as a taxpayer to recognise the right avenues for these transactions to ensure compliance and accuracy on your tax return.

Making Payments to SARS

When you owe money to the South African Revenue Service (SARS), it is your responsibility to make a payment by the due date specified on your tax assessment. Payments can be made in the following ways:

- Electronic Funds Transfer (EFT): Utilise your bank’s online platform to transfer the owed amount directly to SARS’s bank account.

- Branch Payments: Visit a bank branch and make a deposit into SARS’s account.

- SARS eFiling: Log into your eFiling account and initiate a payment via the integrated payment functionality.

Here is a concise table displaying the payment methods and their references:

| Payment Method | Reference Needed | Additional Notes |

|---|---|---|

| EFT | Tax Reference Number | Include the specific payment reference |

| Branch Payment | Deposit Reference Number | Obtainable on your eFiling account |

| SARS eFiling | eFiling Payment Gateway | Payment is linked to your account instantly |

Be sure to use your unique tax reference number as the beneficiary reference to ensure the payment is allocated to your account correctly.

Processing Refunds

SARS issues refunds to taxpayers after an assessment process where it is determined that you have overpaid on your tax. To facilitate a refund, you need to:

- Ensure Accurate Bank Details: SARS requires that your banking information is up to date on your eFiling profile.

- Submit Necessary Documentation: In some cases, supporting documents may be requested by SARS to process your refund.

Refunds are typically paid out using the following method:

- Electronic Payment: SARS will directly deposit the refund into your registered bank account.

Note that SARS conducts audits and verifications which can delay the refund process. It is your right to enquire about the status of your refund if there are undue delays.

Follow all SARS communication carefully and promptly provide any information they may need to avoid further delays to your refund.

Understanding Audits and Investigations

When using the SARS eFiling system, you may be subjected to an audit or investigation at some point. These measures are put in place to ensure compliance and accuracy in your tax affairs.

What Triggers a SARS Audit?

A SARS audit is typically initiated when there is a discrepancy or an irregularity spotted in your submitted returns. This could arise from:

- Unusual Patterns: Repeated losses or large, one-off transactions.

- Information Mismatch: Differences between information declared and information in SARS’ possession.

- Random Selection: SARS also conducts random audits as part of their compliance protocol.

Being aware of what triggers an audit can help you maintain compliance and avoid suspicion.

Responding to Audit Enquiries

If you’re selected for a SARS audit, responding promptly and precisely is crucial.

- Gather Documentation: Assemble all relevant financial statements, invoices, and receipts.

- Reply Formally: Use the SARS eFiling system to submit your response to enquiries.

- Seek Advice: If necessary, consult a tax professional for assistance with complex audits.

Addressing audit enquiries accurately will help you resolve the audit efficiently and demonstrate your commitment to tax compliance.

Legal and Compliance

When interacting with SARS eFiling, you are obligated to comply with prevailing tax laws and procedures. Ensuring legal compliance is imperative, and should there be disputes or appeals, knowing the formal channels is crucial for resolution.

Tax Laws and Compliance

Your Responsibilities: As a taxpayer registered with SARS eFiling, you are required to adhere to the Income Tax Act and other tax legislation. These laws outline your obligations for filing tax returns, paying the correct amount of tax, and submitting information in a timely manner.

- Filing Accurately: Ensure all tax declarations are true, complete, and submitted before due dates to avoid penalties.

- Records and Documents: Keep accurate and comprehensive records as SARS has the authority to request these in the case of an audit.

Dealing with Tax Disputes and Appeals

Audit Process: If SARS selects your filing for an audit, you’ll receive a formal notification. During this period, compliance with their requests for additional information is not optional but a legal requirement.

- Dispute Resolution: In the event of disagreeing with a tax assessment, you can file an objection within 30 days from the date of assessment. If the objection is unsuccessful, you have the right to appeal.

- Documentation is Key: For a successful appeal, you must provide comprehensive evidence supporting your position. This includes relevant financial records, calculations, and any other pertinent documents.

By remaining compliant and understanding your legal rights and obligations, you navigate SARS eFiling with confidence.

Customs and Excise Duties

When managing your business interactions with South African Revenue Service (SARS), it’s critical to understand the protocols for filing customs duties and the implications of excise duties.

Filing for Customs Duties

When you import goods, you’re required to declare them to Customs. Here’s what you need to do:

- Register with SARS as an importer via the SARS eFiling system.

- Complete the necessary declarations for your imported goods.This includes providing exact details about:

- The nature of the goods

- Their value

- The country of origin

Excise Duties and Levies

Excise duties apply to goods produced within the country as well as certain imported goods.

Levies are imposed on:

- Tobacco products

- Alcoholic beverages

- Electronic vapour products

- Certain luxury goods

These duties are aimed at discouraging the consumption of these goods while generating revenue. Each category has specific rates and regulations that your business must adhere to:

- Tobacco: Charged per kilogram on various tobacco products.

- Alcohol: Calculated based on the volume of alcohol and type of beverage.

- Luxury Goods: Applies to goods such as cosmetics and electronics at variable rates depending on the item.

As a business owner, ensure timely and accurate filings through SARS eFiling to avoid penalties and interest on late payments. Stay informed about the latest changes in rates and regulations by regularly checking the SARS website or contacting their support centre for guidance.

Keeping Informed

Staying up to date with the latest information from SARS eFiling is crucial for effective tax management. By accessing the newest updates and educational content, you’ll maintain compliance and streamline your tax submission process.

Accessing the Latest News and Updates

To receive the latest news regarding SARS eFiling, you should routinely check the official SARS website. Here you can find:

- News Alerts: Updates on tax submission deadlines, legislative changes, and system upgrades.

- System Notifications: Real-time announcements in the event of system maintenance or downtime, allowing you to plan your eFiling activities accordingly.

Educational Resources

It’s important to continually educate yourself on tax matters. SARS offers a range of educational resources tailored to aid both individuals and businesses:

- Guides and Tutorials: Step-by-step documents and videos demonstrating eFiling procedures and best practices.

- Workshops and Webinars: Interactive sessions that cover various tax topics and frequently asked questions, providing you the opportunity to deepen your understanding.