The world is currently experiencing a severe shortage of energy for a variety of reasons, including rising demand as a result of rapid population growth, the impact of climate change (for example, the closure of coal mines as a result of heavy rain or concerns about the environment), etc. On the other hand, it is feared that the war between Russia and Ukraine, which began on February 24, 2022, will put an end to several companies and result in a global distribution network disaster for a system that is already struggling.

Metals and Chemical Compounds

When sending metals to Europe, Russian mining operations had not previously encountered significant logistical disruptions in the past. However, under the current circumstances of a war-induced embargo, logistical bottlenecks are becoming more prevalent, which is driving up export costs and increasing delivery times. Russia is responsible for providing a significant portion of the world’s industrial metal supply, particularly in the cases of nickel, palladium, platinum, rhodium, aluminum, and copper.

As a result of the disruption or closure of approximately sixty percent of Russia’s traditional alumina import requirements, the aluminum industry is facing the greatest potential for immediate and significant disruption. This is also the case because Australia, which was previously responsible for 20–30% of Russia’s import requirements, has just recently prohibited the export of alumina ores and other related products to Russia. Since March 22, operations from Ukraine, which is the country that supplies Russia with the most alumina, have also been put on hold.

Because of this, the alumina shortage is now a tangible problem that is posing new challenges for supply chains. This is because aluminum, a vital metal, is used in a variety of applications, including packaging, transportation (including automobiles and aerospace), infrastructural facilities for renewable energy, and wiring. Because there is such a limited supply of aluminum in Europe, it is currently impossible to manufacture sufficient amounts of solar panels as an alternative source of energy in the aftermath of the Russian gas cutoff.

Even sectors outside of Europe that utilize steel or metals from the area are running into serious problems as a result of the current situation. Another important aspect to take into consideration is the fact that Russia is a substantial potash producer and exporter, accounting for approximately 18% of the world’s total potash production in 2021. Another 17% of the world’s production came from Belarus in 2021, which is where the largest producer was, and they have also admitted that they are facing reduced capabilities. In addition, Russia is responsible for approximately 10% of the world’s ammonia production, 20 to 25% of the world’s ammonia exports, and 5% of the world’s urea production.

The Agricultural Supply Chain

A significant number of European farmers cultivate their crops in greenhouses, which call for supplemental heating. Because of the energy crisis, many different types of crops, including cucumbers, tomatoes, sugar beets, and olives, are in short supply. As a result, global supplies of these foods are expected to decrease in the coming months. The high cost of energy is having an adverse effect not only on farmers, many of whom have made the decision not to plant anything whatsoever in the first place but also on other services surrounding the food industry, such as dairy farming and bakery operations.

In a scenario like this one, even the price controls that certain governments have imposed on the energy market are not assisting the supply chain problem. Because the outcome of the conflict between Russia and Ukraine will have a significant impact on the future of the agricultural sector both inside and outside of the EU, the proportion of total exports that comes from the agricultural sector is likely to shift while prices remain unstable.

Agriculture and other food-related industries use direct energy sources such as electricity for electronic water irrigation; fuel usage for farming equipment; and energy needed at numerous stages of food processing, packaging, transportation, and dispersion. Examples of these types of energy sources include: In addition, the use of pesticides and mineral fertilizers results in the expenditure of a significant amount of indirect energy.

In the United States and Europe, the direct and indirect costs of energy account for an average of 40–50% of the total variable costs associated with cropping. These percentages differ based on the type of region and crop. As a result, the industry is likely going to suffer as a result of the spike in fuel prices that was caused by the war.

Costs of Various Types of Fertilizers

The price of fertilizers is also going through the roof, which drives up the overall cost of inputs. Why? Because nitrogen is an important nutrient for all plant life, and ammonia is the first step in the production of all mineral nitrogen fertilizers, ammonia is the most common form of nitrogen fertilizer. Urea is the most widely used form of nitrogen fertilizer around the world, and about half of ammonia can be converted into urea.

Ammonia is produced almost entirely from natural gas everywhere in the world, with production accounting for approximately 170 billion cubic meters. Only China is an exception to this rule, as their ammonia production relies primarily on coal. Fertilizer prices have more than tripled since the middle of 2020, reaching their highest level since the financial crisis of 2008-2009 and setting a record highest possible level in the case of urea. This is because natural gas frequently accounts for 70 to 80% of the operational costs associated with producing ammonia and urea.

Since the beginning of 2021, the price of gasoline in virtually all major gas-consuming regions has been steadily climbing upward. As a direct result of the conflict in Ukraine, benchmark prices in both Europe and Asia reached an all-time high during the first quarter of 2022. The ever-increasing price of natural gas has led to the announcement of the temporary closure of some nitrogen fertilizer plants during the first half of 2022.

Even though the rise in prices of fertilizers has also been caused in part by the recovery of demand and restrictions on trade, it is feared that the progression of war will lead to a scarce supply of fertilizers, which will affect the markets that are dependent on imports. China, the European Union, the United States of America, India, and Russia are the top 5 ammonia producers on the planet and together they account for approximately two-thirds of global production. While Russia has the greatest percentage of production reserved for exports, at around one-fifth, China is the largest manufacturer globally due to its self-sufficiency.

The European Union (EU), the United States of America (USA), and India are also significant net importers. When it comes to urea, a number of the world’s largest consumers are heavily reliant on imports; for example, India imports approximately 30%, and Brazil imports close to 100% of its accumulated urea provision. A significant portion of the area that is used in many African countries is obtained through imports. If there is a shortage of supplies and a subsequent increase in prices, import-reliant regions need to be prepared to face serious impacts.

The crop yields for the following harvest will be negatively impacted if farmers are forced to use less fertilizer as an option, which will further compound the current food crisis. The high cost of food will also hurt production within the country. Wheat and vegetable oil crops are reportedly already being impacted by the deformations of food and fertilizer markets, as stated by the Global Crisis Response Group of the United Nations. Rice, which is the most widely consumed staple food in the world, will be the next crop to feel pressure if there is a shortage of fertilizer and inflated costs proceed into subsequent planting seasons.

A Threat to the Nation’s Food Supply

The conflict in Ukraine has contributed to an acceleration of an already existing price increase for food over the past two years. The current difficulties in food supply chains are the result of several different factors; however, there is a significant connection between these difficulties and the global energy crisis. The disruption, which was brought on by war, has brought into sharp focus the intertwined nature of the food and energy supply chains all over the world.

According to estimates provided by the World Forum Programme, the number of people who will be facing severe food insecurity will have nearly tripled between 2017 and 2022 and has the potential to increase by an additional 17%. Since 2020, several factors have contributed to the sharp increase in the cost of food. These factors include a rebound in demand as a result of the COVID-19 crisis, the impact of unfavorable weather on supply, a growing amount of import restrictions on food products, and dramatically rising costs of inputs, most notably energy and fertilizers.

Because both Russia and Ukraine are significant food exporters, accounting for almost 30% of the world’s total wheat exports combined, the war has become the most significant factor. Both are extremely important contributors to the overall availability of fertilizers around the world. In addition to the wider military conflict, the fact that Russia has obstructed the Black Sea ports has the additional effect of causing disruptions in the export of food and other commodities from Ukraine.

This puts the harvest for this year in jeopardy. The war has caused energy prices to rise, which in turn has had a domino effect on food supply chains, as evidenced by increased energy costs and skyrocketing prices for fertilizer. Because supply chains and industries for food and affiliated inputs such as agrochemicals, fertilizers, fuel, feed, capital, and labor are globally intertwined, a seemingly minor interruption in the supply chain in one area or industry can lead to terrible consequences in another region or sector.

The Automotive Components and Supplies

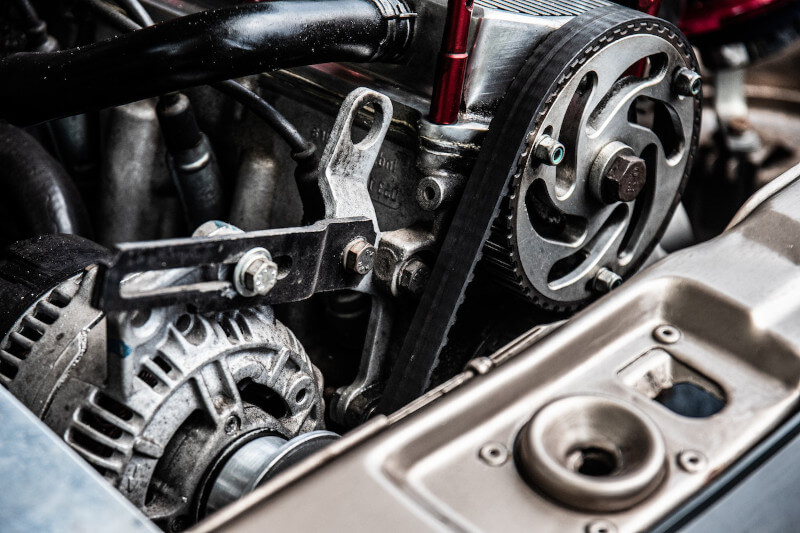

The automotive industry is feeling the effects of rising prices and a limited supply of nickel, copper, platinum group metals, aluminum, and steel products. This is hurting the industry. The situation can become unstable in the coming months as a result of the growing dangers posed by Russia, the intricate supply chains of the automotive industry, and the reliance on key metals.

The assumption that J.P. Morgan Research has regarding global car production has been revised from a growth rate of +4% to a growth rate of 1% for the financial year 2022, but from 6% to 7% for the financial year 2023. The projection for FY23 is based on two different assumptions: the first assumption is that the second half of 2022 will reflect the restoration of the distribution chain in Russia and Ukraine, and the second assumption is that China will quickly recover its production once it has gained control of the COVID-19 pandemic.

Reducing the Severity of the Crisis

The transition to the use of alternative resources is one solution to the current energy crisis. Therefore, it is necessary to establish adequate manufacturing capabilities of necessary power transition materials such as copper, lithium, and others. In addition to this, the chains that supply reliable raw resources and infrastructure facilities need to be strengthened.